This article will take you through everything you need to know when buying stocks in Canada. Maybe you want to learn and start investing, or you already know about stocks and want to learn more about them. This article contains everything you need to know.

There are so many factors to consider when you want to succeed in life.

Aside from taking good care of yourself, you also have to make sure you have some money stored up in case of a crisis. When it comes to saving money, so many people choose to keep cash by themselves stored in a specific place they consider to be safe.

But the question is, what if somebody sees where you have hidden that money?

All that I am trying to say is that, in life, you don’t always have to spend all the money you have gotten, or from your salary, you have to save some of them, and when it also comes to savings, you have to make sure the money can generate extra cash for you.

One of the best ways to make sure your money generates another income for you is to invest your money, and the best way to invest your money is to buy stocks.

Now you don’t have to worry about buying stocks because it has become easy to buy stocks in the comfort of your home. Even if you are in Canada, many brokers make it easy to buy stocks with any amount you have.

Some even allow you to trade stocks on their platforms for free without the need to pay anything.

What's in this article:

What Is A Stock?

To understand what a stock is, let’s say there is a company that has become very successful and you wish you had a share in it, meaning you want to also to make money if the company makes money.

That’s when you decide to buy their shares on the stock market. When you buy shares from a company, you now own and have an ownership interest in that company.

Some companies allow their shareholders to vote on shareholder meetings, you just become part of the company with your shares, and you get qualified to receive dividends when there is a profit on their stock.

Stocks are bought to make profits, and you only decide to sell your shares when you have either made money from it or lost money.

When it comes to selling, it is advisable to sell when your investment has increased and when it comes to selling at a loss, you only sell when you no longer wish to invest in that company or brand.

There are so many things to consider when selling stocks at a loss, and you need to consider all of them before selling them because when you sell a stock simply because the price is dumping and later see it pumping back, you can not stop thinking about it.

When Is The Best Time To Sell Your Stocks?

When The Price Of The Stock Reaches Your Target Sell Price

Anytime you invest in a stock, you have to know the target you will sell. You can decide to invest for a lifetime, but if you are a day trader who constantly makes money daily, you always have to set a sell target when the price goes up.

When The Price Keeps On Tanking

We all buy stocks In other to make a profit from them. Still, sometimes you might invest in a specific stock and check the trend. You will see there is no way for the price to rise, thereby losing your hard-earned money when you realize there is no way the price will shoot up anytime soon. The best thing to do is sell even at a loss and re-enter when the price stabilizes.

When There Is A Bad News About The Company

When you decide to invest in stocks, you also have to follow the company on many platforms. With this, you will be able to hear news about that company, and whenever you hear the terrible news that will make their stock price go down, you sell yours immediately to avoid the loss.

So as a newbie that wants to start trading stocks in Canada? Let’s dive into everything you need to know.

How To Buy Stocks In Canada

Choose Your Preferred Online Brokerage And Create An Account

When it comes to buying stocks in Canada, the first thing you need to do is to choose the best online brokerage to start with. There are many online brokerages out there, so when selecting. There are some factors to consider. Some of the things to consider when choosing an online brokerage are;

- The trading fees

- Does it offer free trading?

- Management fees

- Does it provide tools for you to research and track your earnings?

When it comes to choosing the best online brokerage, Questrade and Wealthsimple are the most popular and most used online brokerage for buying stocks in Canada. They both have low trading fees and have the best customer support in case you run into a problem or need clarification.

Choose Your Investment Account

When it comes to investing in stocks In Canada, there are two ways to go about it, either you support using TFSA, RRSP, or a registered and non-registered account.

When it comes to RRSP, you get tax deductions, but you will be required to pay income tax on your profits in retirement, and when it’s time to make a withdrawal, you get to withdraw funds for free without any taxes.

TFSA, on the other hand, is a tax-free account, and this account can be used to earn tax-free returns forever.

Study The Market

This is the next step you have to take. Investing in stock shouldn’t be a random thing. When you want to buy shares in a company, you will first have to go about how the company operates, what has been making their stock price go up, reasons for the downtrend of their stock chart, and many more.

Once you do this research, you will be equipped with a lot of knowledge about the stocks you want to invest in. You will also get to know when to buy or sell your shares.

Fund Your Account

Now that you are done with your research, now is the time to fund your account and start your stocks trading. So all you have to do is fund your preferred investment account, and you are now good to go.

Choose Your Investment Strategy

One thing you should never do is invest without having a strategy. Having a plan helps you maximize your profit and makes sure there is not too much loss.

Here are some of the strategies you need to consider before buying stocks in Canada:

Dividend investing

This is one of the most popular known forms of investing. You invest in companies or brands that later pay you dividends from your investment with dividend investing.

Growth investment

Some stocks do not pay dividends until they become more popular, like Meta and Apple, and that is when you will be paid bonuses. There are long-term investments. If you have some money that you are not using anytime soon, you can invest in this type of investment.

Start Trading

So now you know the type of investment you want to make, and now is the time to start trading. You have to know that, with stocks, you can’t just buy them anytime you want, and you can only trade stocks at stock market hours.

The New York Stock Exchange, for example, opens from Monday to Friday from 9:30 am to 4:00 pm EST.

If you cannot trade on market hours, there is also a way to go about it: setting up the trades for it to be executed at market hours for you.

Here are some of the terminologies you need to know when it comes to buying stocks

Limit order: The price trade will be executed when it reaches that limit.

The market order is the current buying and selling price of a stock or token.

Bid price: This is the price you are selling your stock. The price you set to sell your stock is the bid price.

Ask price: This is the amount someone is selling their stock. Most of the time, people trade for profits, so when you see a high selling price, you can set a limit order for a price you can buy.

This will ensure your order is executed when someone decides to sell at your given buy price.

What Are OTC Stocks In Canada?

OTC stands for ‘Over The Counter stocks. These stocks are traded by broker-dealers who are not mainly from centralized exchanges like NYSE or TSX but rather they are individuals or investment groups that trade stocks for their clients or themselves.

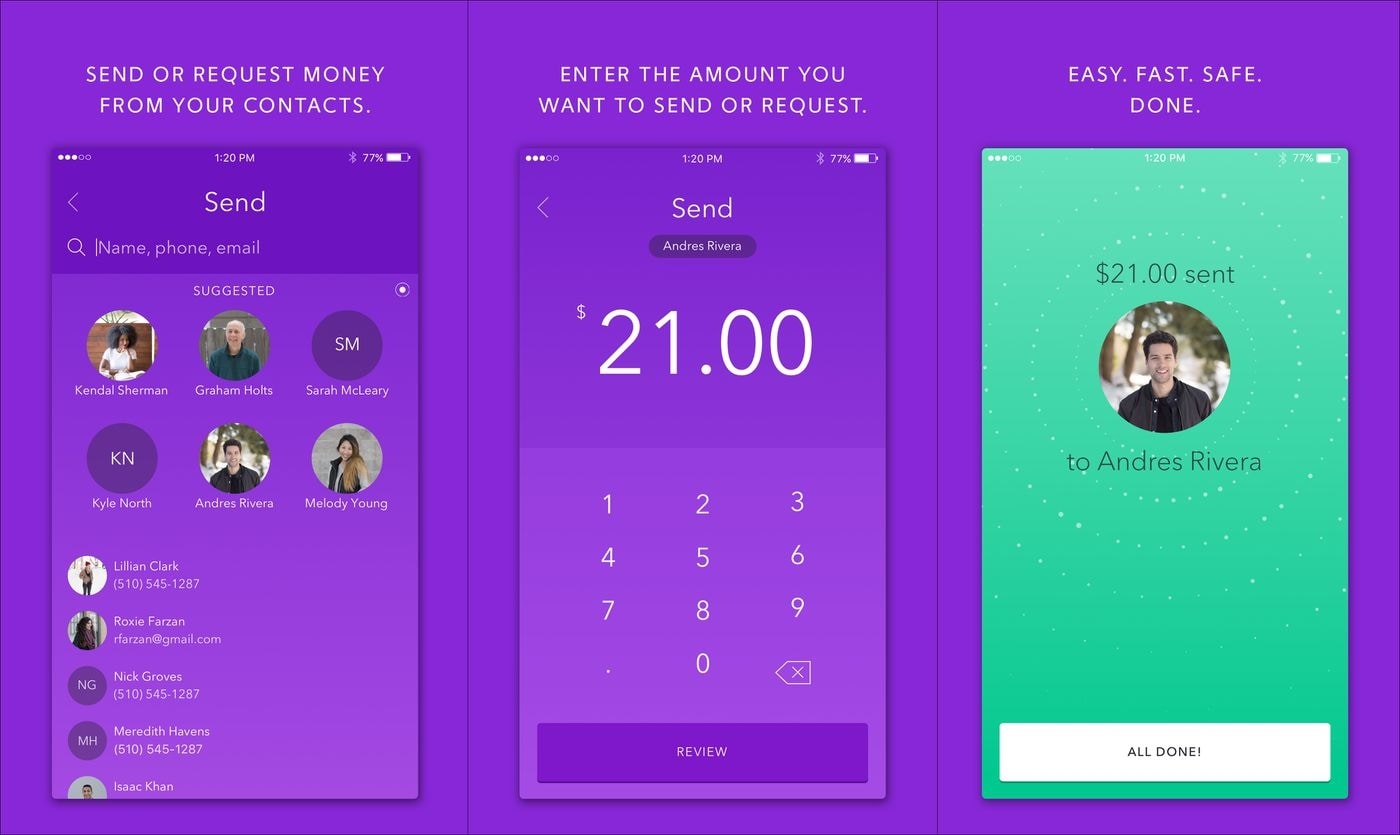

How To Buy OTC Stocks In Canada

Look for Canadian Securities that allow you to trade OTC Markets and sign up on their platform.

After successful signup, search for the stock ticker symbol.

After selection, you will see the chart and the recent trades. To buy a company share, you will have to type in the quantity and the amount you want to pay for it.

Type in the amount you want to buy (Limit order) instead of buying it at a current price. This will make sure you are not paying too much for the stocks.

Wrapping Up

It is always advisable to put your money to use. In Canada, maybe you have received your Canada PRO or your Canada RIT and are wondering how to put that money to use. The best way to increase that money or any money you have is to buy stocks.

That is why in this article, we decided to take you through everything you need to know about buying stocks in Canada. We covered what Stocks are, and how to invest in them.