Sending and receiving money has never been like it used to be. Now you can send money within seconds by just dialing or pointing your phone camera to a QR Code.

There have been many payment methods to choose from when sending and receiving money. Since there is competition among them, they all try their best to stand out to attract many customers.

In this article, we will talk about one of them that has become popular. You could even hear it in movies, and you will see people mentioning it when they want to send money to someone.

The one we are going to talk about is Cash App. What is Cash App? When was it launched? Which countries is Cash App accessible in? Is Cash App accessible in Canada, and how to use Cash App in Canada?

These are all the questions that we will get answered in this article. If you are in Canada, we will also cover Cash App alternatives that you can use in Canada.

What's in this article:

So What Is Cash App?

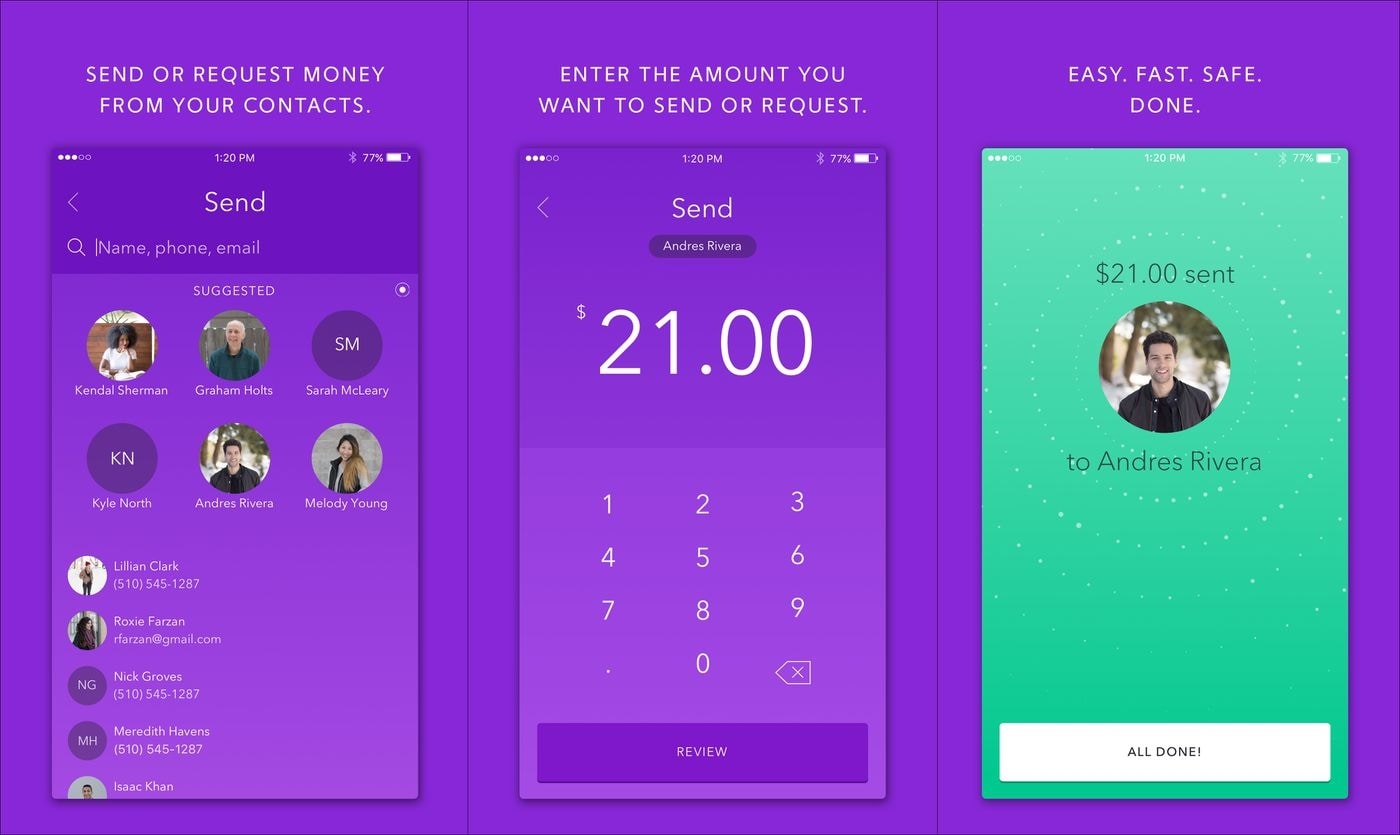

Cash App is a mobile payment service launched in October 2013. It is used to transfer money to another person using your phone; you also get to share money with other people’s bank accounts without any stress.

To use Cash App, users will have to create a $Cashtag, simply a unique username that people will use when sending you money.

When you decide to send money using Cash App, you can send it using the receiver’s email address, phone number, QR Code, or the person’s $Cashtag.

Cash App can also buy and sell Bitcoin right from the app for cryptocurrency lovers. Buying and selling Bitcoin using Cash App is instant and one of the fastest ways to own yourself a cryptocurrency.

Cash App makes it easy to trade stocks right from the app when it comes to investing. This feature was added in 2020. with Cash App, you can buy fractional shares of any stocks with any amount you have.

Is Cash App Available In Canada?

Currently, Cash App is not available in Canada. To use Cash App, one will have to reside in US or United Kingdom.

Cash App started in 2018, and it expanded to the United Kingdom. We believe the company will expand to other countries like Canada as time goes on, but for now, Square Inc, which is the company that owns Cash App, hasn’t made any announcement on expanding to Canada.

How To Get Cash App In Canada

There are ways around it if you want to use Cash App in Canada. Please note that with these steps, you will be able to get yourself a Cash App account and can use it to make payments in the US, and receive payment from someone in the US to your Canada account. You are maybe paying for a service, paying for someone you are owing, or sending money to a loved one in the US.

Here are the steps to get Cash App in Canada:

Before that, you should make sure you have a Transferwise account. This is a payment method to link your Cash App account to send or receive money.

- Download and install a VPN and change your location to Canada or US since Cash App is currently available in both countries (for the VPN, we recommend Express VPN)

- Visit the google play store or Apple app store, change your location to either USA or UK and download the Cash App app.

- Sign up with your details, be it email and confirm the setup

- Now skip the field that is requesting you to link your card and proceed to create your $cashtag

- You will be requested to add your bank details.

- Here is where you will link the account with your Transferwise account details. After a successful linking, you can now send and receive money using Cash App in Canada.

Maybe these steps are way too long for you to follow, or you do not have a Transferwise account, or perhaps you want to know if there are Cash App alternatives in Canada. The truth is, there are many of them here in Canada.

Now let’s cover the best Cash App alternatives in Canada for you to use

Cash App Alternatives In Canada

Interac e-Transfer

Interac e-Transfer is one of the most popular payment services in Canada. With this service, it is easy to make payments in Canada. Sending money to your family and friends using Interac e-Transfer takes less than a minute.

You don’t even need to download any third-party apps because if you have a bank account, you already have Interac e-Transfer, and you need to access it through your online banking app.

Interac e-Transfer works similarly to the Cash app. You can send money to someone by just using their phone number, email bank number, or straight to their bank account.

The best part is, it is free to send money using Interac e-Transfer, although some financial institutions might charge $1-$2.

KOHO

KOHO has been in the system since 2014. Since then, they have made payment one of the easiest things. Aside from that, it is known to be the best payment service with the highest saving rates in Canada.

KOHO does not only do P2P transfer, but it has a lot more to offer than even Cash App. With KOHO, you get a cashback card, which will allow you to earn 0.50% cashback if you use their KOHO prepaid Visa.

You also get to do free transactions anytime you pay bills or send money. Sending money to other KOHO users too works instantly.

Wealthsimple Cash

Wealthsimple is a free service in Canada; it is one of the most recommended Cash App alternatives.

The service boasts over 1.5 million customers and allows you to make instant money transfers. All you have to do is use your friend’s username or email address to make a payment. When someone is also making payment using Wealthsimple, this sender only needs your username or email.

The best part is, it is free to send money using Wealthsimple. You don’t pay for anything when sending money or withdrawing money.

You can also buy and sell Bitcoin and Ethereum on the platform. Wealthsimple makes trading cryptocurrencies easy. You don’t have to worry about getting scammed by people or even exchanges.

Wise Money Transfer

Wise is an international money transfer service that makes it easy to make payments to your family and friends in Canada and even other countries.

Wise makes it easy to transfer money in Canada and makes it easy to send money to other countries. This beats Cash App as Cash App is currently available in two countries.

With Wise, you can send money to more than 50 countries; Wise makes it easy to get the conversion. Let’s say you want to send your CAD to UDS. Wise will get you covered with the conversion and let you send the money without any hassle.

Wise boats of over 10 million customers and what makes them stand is how they don’t charge any hidden fees when making conversions or sending money.

Paypal

Of course, Paypal works in Canada. Although Paypal does not work in some places of the world, Canada is one place where you can use Paypal.

If you are looking for another alternative to Cash App in Canada, then Paypal is the best payment service for you.

This service allows you to send money to family and friends, make payments, request payments and do a whole lot using your email address or your username.

With Paypal, you can send money for free Paypal by using your Linked bank account or Paypal balance. To send money to someone using Paypal, the recipient will also have to use Paypal to receive the money.

Using Paypal is simple. You visit their official website, create an account and link your credit card to start sending and receiving money.

Conclusion

There are many payment methods around the world, and some are popular based on how it works, the flexibility, availability, and the charges, one of which has been known as Cash App. In this article, we went through the Cash App.

We talked about using Cash App in Canada and the top 5 Cash App alternatives that Canadians can use.