The world is now evolving and now making payment has been much easier. Gone were the days people had to visit the bank to send or receive money. Things have changed in everything, including how money is sent and received.

At first, it was also not easy to receive money from someone as sending was a bit tiring. Now everything has changed, directly someone can send you money within minutes by just tapping on their phone.

There are so many payment services around the world, and in today’s article, we will talk about Venmo. Together we will cover everything you need to know about Venmo, talk about Venmo in Canada, and also Venmo alternatives in Canada.

So without wasting much time, let’s dive in.

What's in this article:

What Is Venmo?

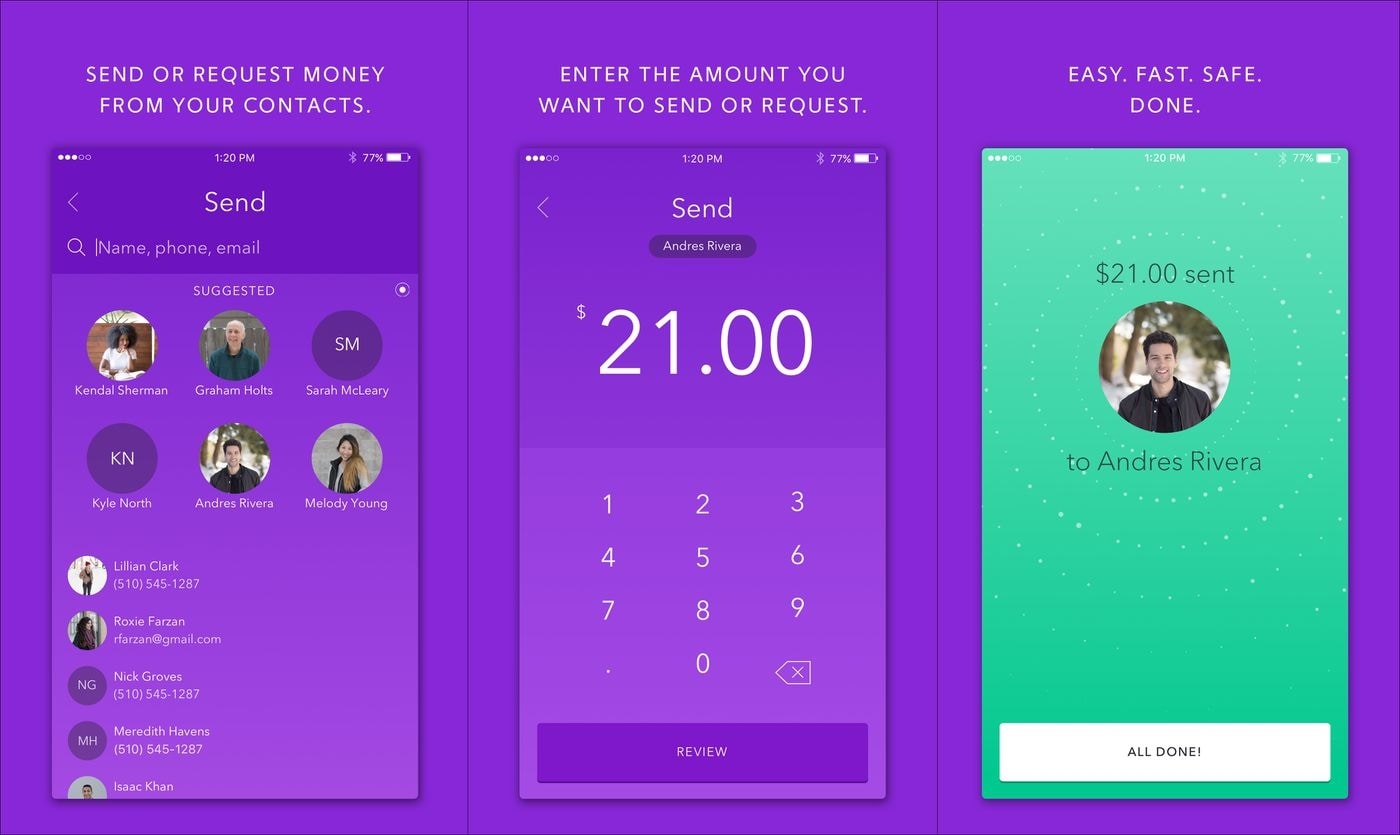

Venmo is a mobile payment based in the US. The platform is owned by Paypal and was launched in 2009.

The platform’s main aim was to make it easy for people to send and receive money using their phones, to make it easy for people to split bills, pay for movies, and even rent.

To use the Venmo service, a user needs to create an account using their mobile app or website. To sign up, you will need to provide your personal information such as your name, email address, bank account information, and American phone number.

Is Venmo Available In Canada?

Venmo is currently not available in Canada but only in the US. To use Venmo, you must be living in the US, sign up with your details and American phone number so that you can send and receive money using the app.

With Venmo, there is nothing like monthly fee charges; it is also free to send money from your Venmo account to another Venmo account or account number.

You can also buy cryptocurrencies and make in-app purchases using your Venmo account.

Why Is Venmo Not In Canada, And When Will Venmo Be Available In Canada?

Venmo has currently not disclosed about expanding outside the US. Although we know Paypal and Paypal own Venmo is known worldwide, chances are this company will be planning to expand Venmo to other countries like Canada in the coming years.

We know Paypal is a well-known company, and expanding Venmo to Canada wouldn’t be a big deal. For now, we have to wait and give them time.

How To Get Venmo In Canada?

You can still use Venmo in Canada if you can get all their requirements: an American phone number, your details, and a bank number.

There are so many websites that will allow you to buy yourself an American number, and one of my favorites is sonetel.com. This website will enable you to purchase an American number and will allow you to use it, answer calls, send and receive messages with it from almost anywhere in the world. There is a way to create a bank account for the American bank account even if you are not living there, and you can read this article covering how to create an American bank account.

So after getting all the details, here is how to use Venmo in Canada:

- Download and install a VPN (I recommend Express VPN)

- After a successful installation, change your location to the US and connect

- Now visit the google play store and go to profile > Settings And General > Country> and change your country to the US.

- Now head back to google play store and search for Venmo and install. You can also use the web by visiting Venmo.com and clicking on Sign up.

- Sign up with your details by filling in your details, password, and recently bought American number.

- A confirmation code will be sent to your number. Type it in to verify your registration.

- Please enter your bank account and verify it.

- That’s it. You have successfully created a Venmo account in Canada, and now you can use your Account to pay for any service in the US.

But do you know there are Venmo alternatives in Canada? Yes, you heard me right. Many payment services in Canada work like Venmo.

So if you are in Canada and the steps mentioned above is tiring for you, then you can use one of the Venmo alternatives we are going to cover

Venmo Alternatives In Canada

Interac e- Transfer

If you are looking for a Venmo alternative in Canada, then Interrac e-Transfer is one of them.

You don’t need to download any third-party apps because you already have it with Interac e- Transfer if you have a bank account, and it can be accessed through your financial institution’s app.

The platform allows you to send money to your friends and families with just their mobile number, email, or bank account. You can also receive money through your Interac e- Transfer.

Interac e- Transfer has also collaborated with Western Union and master card to make sending money abroad easy.

How To Send Money Using Interac e- Transfer

- Log in to your online mobile banking app and choose Account

- Go to Add Your Recipient’s mobile number or email

- Please type in the amount you want to send, your security question, and then share it with the recipient.

Wealthsimple Cash App

You ever heard of Cash App? Well, that is also another popular payment service that is currently available in the US.

And in Canada, we have a similar one with a similar name called wealth simple Cash App. This service works just like Venmo, and all you have to do is download the app and send money to anybody in Canada.

There are no fees attached to amount transfers, and depositing to your Wealthsimple Cash App is relatively easy, all you have to do is load your Account using your Visa card, and you can even deposit up to $500 with a monthly maximum of $5000

How To Send Money Using Wealthsimple Cash App

- To send money using the Wealthsimple Cash App, you have to visit the Google play store or app store and download the app.

- Sign up with your details such as your name, email, and password

- Now set up your profile the way you want it

- Now you can send and receive money using the Wealthsimple Cash App.

Wise

Maybe you wanted to send money to someone that led you into checking if you can use Venmo, but in this article, we covered Venmo, and perhaps you couldn’t follow the steps to create an account on Venmo. don’t worry Wise is a Venmo alternative that allows you to send money from Canada to the US, and at the same that you will be able to use it to send and receive money in Canada

Wise has an easy-to-use app that makes sending and receiving money one of the easiest things to do.

You can fund your Wise Account through your bank account or your credit card without any hassle and makes you know the transfer fees as you make international money transfers.

How to Send Money Using Wise

- Download and install the Wise app and sign up or sign up using their website

- After successful signup, tap on Send to transfer

- Type in the amount you want to transfer

- Choose the purpose of the transfer

- Fill in your details

- Type in the recipient’s email address or phone number

- Review your transfer and choose how you want to pay for the transfer

- After a successful transfer, you will receive a mail to confirm the transaction.

Black

Black is one of the most popular credit card operators, giving its users awards. The platform is a Venmo alternative due to its similar features. Black allows you to install their mobile app and then use it to send and receive money, pay bills and do more.

You can withdraw up to $500 a day and pay a flat fee of $5. This platform also allows you to transfer money to any Canadian user’s debit card or bank account.

Plastik currently has a signup bonus. When you get approved for their Plastik Visa Card, you will receive 5000 points equivalent to $20. You can then convert it into money and spend it any way you want it

How To Send Money Using Plastik

To send money using Plastik, you have to visit their website or app and log in with your details. After that, you tap on send and fill in the recipient’s details. After confirming, the money will be sent.

ShakePay

ShakePay is one of the best payment services to use in Canada. Do you know why? Because it got a lot more than you can ever imagine.

With shakePay, you can send and receive Canadian dollars, Bitcoin, Ethereum, or any other popular cryptocurrencies to your family and friends who are also using the ShakePay app.

You can load your ShakePay Account with your bank account or your visa or MasterCard. As soon as you load your Account, you can send it to anybody you want to send it to; you can also convert it to cryptocurrencies and store or send it to someone.

So now, when someone asks you to send them crypto, you don’t have to look for crypto exchanges, and you have to use ShakePay; when someone also asks you for money, ShakePay also sends money. That is why it is one of the best Venmo alternatives in Canada.

How To Send Money Using ShakePay

- Login to your ShakePay app

- Tap on Send

- Type in your friend’s username

- Choose the type of currency you want to send, CAD or any cryptocurrency.

- Now input the amount you want to send the receiver

- Go through the transaction again and then confirm it.

Conclusion

Venmo is one of the easiest ways to send and receive money. This article went through everything you need to know about Venmo, and we covered if Venmo is available in Canada and when it will be available in Canada.

We know some people will still want to try the app in Canada, so we covered an easy trick used to create a Venmo account and use it in Canada. For our readers that was finding it difficult to follow the steps, we also covered the 5 best Venmo alternatives in Canada for you to use.